11

2025

-

09

A casual discussion on the challenges and future of LED companies

Looking back at the development trajectory of the light-emitting diode (LED) industry feels like gazing at the industry lifecycle curve depicted in a textbook.

Once hailed as the "green light source of the 21st century," it carries the mission of energy conservation, holds immense potential to contribute to environmental protection, and boasts a promising market outlook—attracting countless global investors and companies eager to get involved.

However, the past glory has not translated into sustainable prosperity. Today, the entire industry is widely mired in a predicament of low profitability and intense competition—what is unmistakably recognized as an "involutionary" sector. Many companies are struggling to survive in razor-thin profit margins, while the market exhibits the classic "red ocean" dynamics, creating a stark contrast—and even a jarring disconnect—with the initially optimistic visions and expectations.

A deeper analysis reveals that the current crisis in the LED industry is not merely a market downturn, but a structural crisis driven by the overlapping impact of industrial structure, policy changes, technological advancements, and shifting consumer demand.

This crisis has eroded the industry's ability to create value, making traditional cost-based competition and strategies focused on scaling up increasingly unsustainable.

Although LEDs are also a niche segment within the semiconductor industry, unlike more established semiconductor sectors such as integrated circuits, which have rebounded strongly after periods of adjustment, LEDs have remained largely stagnant for years. What has led to this situation in the LED industry? In this article, we first delve into the underlying, deeply rooted causes behind the LED industry's current crisis, and then draw on successful case studies from globally leading companies to systematically evaluate four viable strategic approaches for moving forward.

Ultimately, the article will look ahead to the future, highlighting how LED companies can capitalize on emerging sectors with high growth potential within the broader AI-driven semiconductor trend. It aims to provide decision-makers at struggling firms with a clear, actionable framework to help them break through strategic challenges and once again unlock greater value.

Chapter One:

The Root Cause Behind the Collapse in Profitability of the LED Industry

At first, everyone thought it would be an ordinary winter. But the LED industry’s recovery has repeatedly fallen short of expectations—this winter is proving far longer and more challenging than anyone imagined.

Today's industry challenges can no longer be attributed to a single external shock or short-term market fluctuations. Instead, they represent a classic case of value erosion driven by inherent structural flaws within the industry itself.

In this section, we systematically diagnose the four root causes of the crisis using frameworks such as industrial structure analysis, lifecycle theory, policy impact assessment, and an in-depth analysis of the underlying demand for LEDs.

1.1 Market fragmentation is a structural contradiction caused by excessive competition.

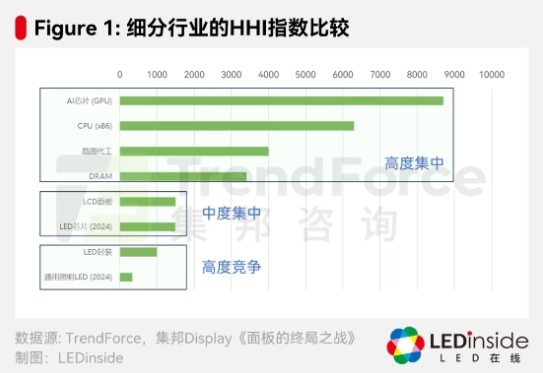

One of the key indicators for assessing industry competitive dynamics and profit potential is market concentration. A highly concentrated market typically implies that a small number of leading companies hold significant pricing power and enjoy stable profit margins.

Conversely, a fragmented market inevitably leads to intense price competition and the ongoing erosion of profitability—precisely what we see in the LED industry, particularly in the lighting packaging segment.

Through quantitative analysis using the Herfindahl-Hirschman Index (HHI), it becomes clear that the LED industry structure has fundamental flaws. Compared to certain high-barrier sub-sectors within the semiconductor industry, the HHI for the LED packaging sector differs by orders of magnitude.

As shown in the figure, the HHI for the AI GPU market stands at approximately 8,700, reflecting an outright monopoly; meanwhile, the DRAM market clocks in around 3,400, indicating a classic oligopolistic structure. Over the past few years, companies like NVIDIA and SK Hynix have reaped substantial profits—not only by riding the wave of the AI industry trend but also by capitalizing on this highly concentrated market structure.

However, the HHI for the LED packaging industry remains well below 1,000, with the general lighting LED segment recording an HHI as low as 342 in 2024—a highly fragmented market structure.

This fundamental structural difference is the core reason why the LED industry's profitability falls far short of other semiconductor sectors.

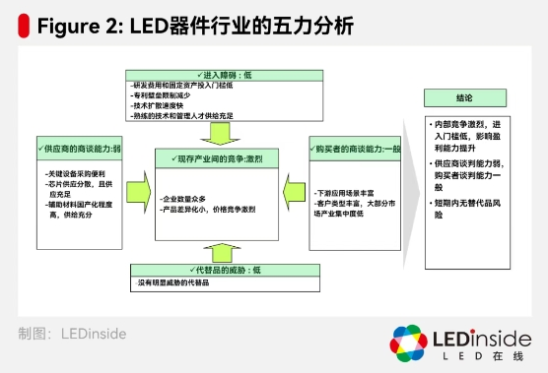

Further applying Porter's Five Forces model to conduct a comprehensive analysis of the LED device industry can more clearly reveal its fiercely competitive environment.

Threat from new entrants: High. Thanks to technology diffusion, an ample supply of talent, and diminishing patent barriers, the industry’s entry threshold continues to decline. As soon as profitability in the sector improves, new competitors are likely to emerge.

Competition among existing players: Extremely high. With a large number of LED companies and severe product homogeneity, competition has become intensely focused on price wars—directly undermining profitability as the most critical threat.

Supplier bargaining power: Weak. Key equipment, such as MOCVD, is easy to procure, while the upstream chip supply remains fragmented yet ample. This situation has a neutral impact on the industry's profitability—on one hand, it makes it harder for upstream key suppliers to exert control; on the other hand, it could further erode the scarcity of upstream resources.

Buyer bargaining power: Moderate. Downstream applications are diverse, but due to limited product differentiation, customers are highly price-sensitive.

Threat from substitutes: Low. There are currently no lighting technologies that can fully outperform LEDs in terms of both cost and performance in the short term.

The conclusion is clear: in a market with low entry barriers, numerous internal competitors, and highly homogeneous products, companies have virtually no pricing power.

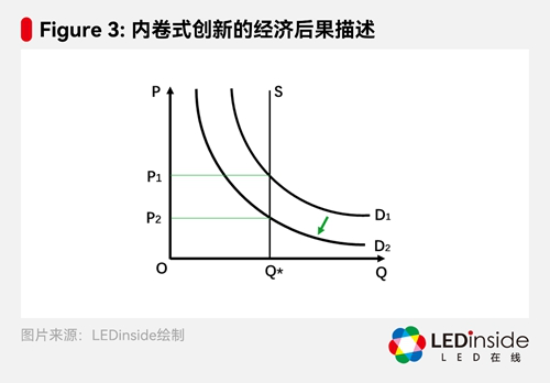

It seems the only competitive strategies left are cost control and price cuts, plunging the entire industry into a vicious cycle of "involutionary innovation"—where companies’ efforts to improve performance metrics actually end up driving even fiercer price wars, ultimately eroding the overall value of consumer demand.

One of the involutionary innovation strategies that the LED industry excels at is improving performance while keeping prices unchanged. However, when performance enhancements no longer spur fresh demand, consumers actually end up buying less—even as products become better. This causes the demand curve, initially D1, to shift leftward to D2. Meanwhile, once production capacity has been established, it becomes extremely difficult for companies to exit or pivot toward other applications. As a result, the supply curve effectively becomes nearly vertical, inevitably leading to a decline in prices—from P1 to P2.

But when prices fall below the level needed to cover variable costs, businesses face an existential crisis. By then, attempting to raise prices to offset rising cost pressures would already be too late.

This predicament is precisely the direct cause behind the widespread low profitability, razor-thin net profit margins, and even losses experienced by China's LED companies.

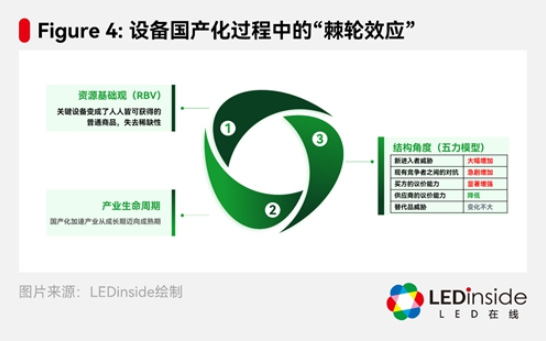

1.2 The Double-Edged Sword of Policy: The "Ratchet Effect" of Industry Subsidies and Equipment Localization

The challenges facing the LED industry weren’t entirely driven by market forces alone—they were profoundly shaped by industrial policies. Particularly in China, local governments have actively sought to establish “Optics Valley” and nurture strategic emerging industries, introducing a wide range of industry subsidy programs since 2009. Among these measures, the most notable was the generous procurement subsidies for core production equipment like MOCVD systems, which could reach as high as tens of millions of RMB per unit. While these incentives briefly spurred the rapid growth of a massive industrial cluster, their long-term consequences have proven far more unpredictable than anticipated.

The existence of these industry subsidies has distorted normal expectations of investment returns, sparking an irrational "gold rush." Coupled with the intense competition among companies, local governments, and even between businesses and government entities over access to these incentives, the ultimate outcome is a proliferation of highly similar projects—leading to a surge in production capacity that far exceeds the market’s ability to absorb it.

Even more alarming is another policy-driven trend: the domestication of critical equipment and materials, which has unexpectedly triggered an irreversible "ratchet effect." From the perspective of resource-based corporate competitiveness, once key equipment—such as MOCVD—that previously acted as a technological bottleneck and high barrier to entry, along with auxiliary materials like phosphors and encapsulation resins, are successfully developed and gradually become widespread, they transform from scarce strategic resources into commonplace commodities available to everyone. This seismic shift not only dismantles the industry’s longstanding supply constraints but also permanently lowers the barriers to entry, accelerating the industry’s maturation process—and once this happens, there’s no going back. It’s as if the industry has been set on a one-way wheel (the ratchet), locked in a trajectory of perpetual growth and consolidation.

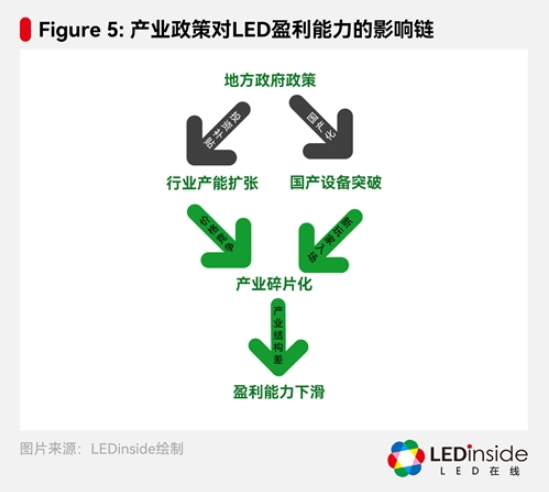

This process actually implies a clear chain of cause and effect: large-scale government subsidies have fueled irrational investment, leading to severe overcapacity. At the same time, incentives for domestic production have accelerated the diffusion of critical core technologies, sharply lowering the technological and capital barriers to entry into the industry. As overcapacity combines with these reduced entry thresholds, the market sees a surge of new competitors, rapidly fragmenting the industrial structure.

The fragmented market structure—characterized by an extremely low HHI index—has directly led to a homogenization of corporate competitive behavior, forcing firms into brutal price wars—a phenomenon often felt as the relentless cycle of "involution" at its most intense. Ultimately, these policies, which may have been well-intentioned in the first place, have inadvertently triggered a structural breakdown of industry barriers, resulting in a lasting decline in the overall profitability of the sector.

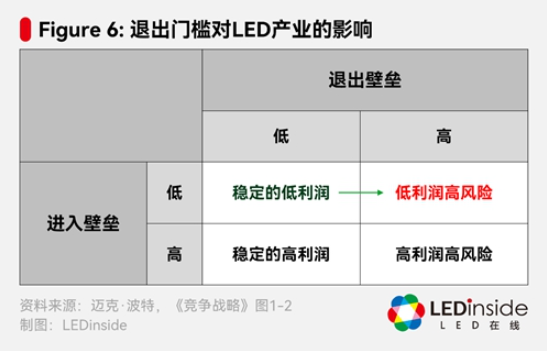

Furthermore, thanks to the existence of subsidies, companies can no longer easily exit when they find themselves caught in the trap of involution—intense internal competition. The subsidies themselves imply that recipient firms have a social responsibility to boost employment and contribute to tax revenues. This creates significant barriers to exit for the industry, thereby prolonging the painful period of industrial adjustment and trapping the entire sector in a vicious cycle of low profitability and heightened risk.

Originally, LED was considered a fragmented industry with low profit margins—but at least it could sustain stable, modest returns that matched the associated investment risks. However, rising barriers to exit have fundamentally altered the industry’s nature, turning it into a high-risk, low-profit sector. As a result, the LED chip industry has found itself stuck in this awkward and challenging predicament over the past few years.

According to Mike Porter, the best scenario is one with high barriers to entry and low barriers to exit—though even that’s not ideal. When both entry and exit barriers are relatively low, it already signals a less-than-optimistic outlook (as is typical in the LED industry). Conversely, an industry with low entry barriers but high exit barriers—such as the LED sector after receiving subsidies—is undoubtedly the worst-case scenario.

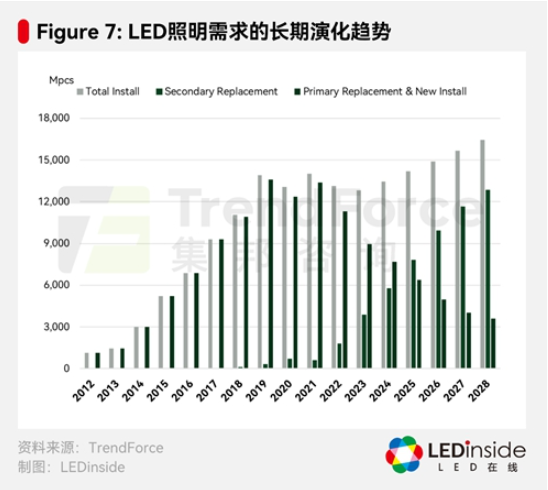

1.3 Reluctantly Watching Flowers Fall: Lifecycle Maturity and Diminishing Marginal Utility

Every industry has its own lifecycle. According to TrendForce analysis, the general lighting market is currently at a critical juncture, transitioning from the latter part of its growth phase into maturity. Data shows that the primary driver of market expansion—initial demand stemming from replacement and new installations—has shifted toward secondary replacement needs. As a result, the overall market growth rate has slowed significantly. This signals that the era of explosive growth in the market has come to an end, marking the industry’s entry into a phase characterized by capacity rationalization and intensified competition over existing market share.

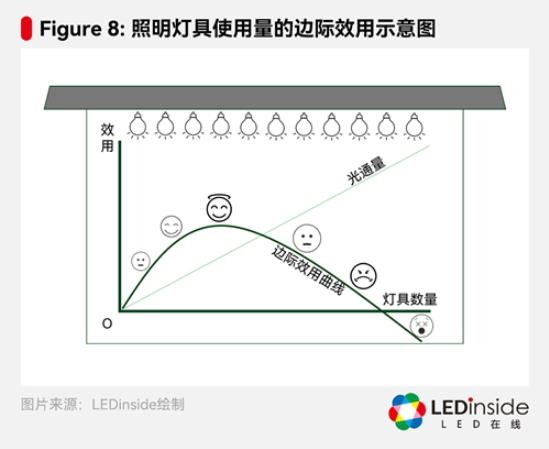

Meanwhile, LED technology itself is also facing the challenge of "diminishing marginal returns." First, there’s the diminishing return in terms of performance improvements. In the lighting sector, LED technology has already achieved levels of luminous efficacy (lumens per watt), lifespan, and reliability that satisfy the vast majority of consumers. While the technology continues to advance, these incremental enhancements now offer only minimal gains in improving the user experience. For instance, increasing a bulb’s efficacy from 150 lm/W to 160 lm/W is virtually imperceptible to the average household user, making it unlikely to inspire any new purchase or replacement decisions. Moreover, there’s a practical limit to how many lights can be effectively used. For example, if a room requires a reasonable setup of five lights, adding five more would not only waste energy but could also lead to undesirable side effects, such as glare and light pollution—ultimately reducing overall utility rather than enhancing it.

As shown in the figure above, as the number of light bulbs in the room increases, the luminous flux grows linearly and proportionally. However, the perceived benefit to people varies: initially, adding more bulbs makes the room brighter, enhancing comfort and boosting mood. But once the number reaches a certain point—typically 4 to 5 bulbs—continuing to increase the number may no longer lead to greater happiness. In fact, additional lights could cause discomfort due to glare, and further increases might even result in physiological harm from excessive brightness, ultimately leading to negative effects.

This phenomenon stands in stark contrast to the high-performance computing (GPU/CPU) space. In the computing domain, advancements in computational power—such as higher TOPS—can directly unlock entirely new application scenarios, like more sophisticated AI models or games with dramatically improved graphics, thereby generating entirely new demand. Particularly in areas such as AI training, where parallel-processing architectures are employed, the system's overall performance hinges critically on the speed of each individual subsystem. As a result, customers are often willing to pay exponentially higher costs for even marginal gains in computational power.

However, in the field of general lighting, further increasing luminous flux does not lead to a qualitative improvement in user value.

The intrinsic nature of this demand dictates that the efficiency of converting technological innovation into value remains extremely low. Unlike other tech sectors, it cannot sustainably generate additional market growth through continuous technological iteration, nor can it easily encourage consumers—once their basic lighting needs are met—to pay for these extra performance-enhancing innovations.

1.4 Water from the New World won’t quench your immediate thirst.

Faced with stagnation in the traditional lighting market, many companies are pinning their hopes on emerging applications such as Micro/Mini LED and automotive LEDs. However, according to TrendForce’s forecast data, while these new markets hold significant potential, they are unlikely to quickly close the substantial gap left by the decline in the conventional market in the near term.

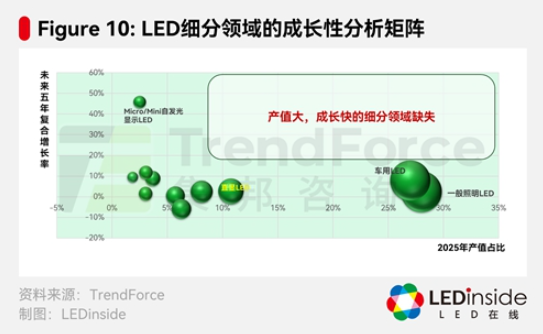

Analyzing the output value share of each sub-sector in 2025 and the five-year compound annual growth rate (CAGR) reveals a sobering reality:

While general-purpose lighting LEDs and display backlight LEDs account for a significant share of the market value, their growth remains sluggish—or even in decline (with CAGRs in negative territory or low single-digit percentages)—due to saturated demand and intense competition. In contrast, self-emissive Micro/Mini LED displays and automotive LEDs are experiencing exceptionally strong growth, boasting compound annual growth rates as high as 20% to 60%. However, despite this impressive momentum, these segments will still represent only a relatively small portion of the overall market by 2025.

This reveals a critical strategic dilemma: while the "old world" of the LED industry is crumbling at the profit level, its sheer size remains substantial. Meanwhile, the promising "new world," though growing rapidly, still lacks the scale to provide enough momentum for the industry as a whole. As a result, LED companies find themselves trapped in a painful transition—struggling to keep their traditional businesses afloat, yet unable to rely fully on the nascent opportunities from their emerging ventures to meet immediate needs.

Additionally, LED products boast an exceptionally long lifespan—often several times longer than traditional light sources such as energy-saving lamps, CCFLs, and halogen bulbs—significantly reducing the frequency at which existing markets across all application areas need to be refreshed, thereby further exacerbating the challenge of meeting demand.

In summary, the crisis in the LED industry is systemic and structural. A fragmented market structure, policy-driven overcapacity, the maturation of the industry lifecycle, and diminishing marginal returns from technological advancements have collectively squeezed profit margins in mainstream markets such as general lighting.

However, the emerging applications currently lack sufficient scale in the short term, making the path to transformation fraught with uncertainty. In this challenging environment, businesses must move beyond conventional operational thinking and pursue fundamental strategic breakthroughs to ensure their survival and growth.

Next, let’s look at how several companies tackled their challenges, using case studies from a few of them.

Chapter 2:

Lessons from the Strategic Transformation of Industry Giants

In a low-profit environment driven by structural flaws, the survival and revival of businesses can no longer rely on external improvements or serendipitous opportunities—they must instead rely on careful deliberation and fundamental strategic decisions. This chapter will delve into four distinct strategic archetypes, using the case studies of Samsung, Micron, BOE, and Baoming Technology, to provide struggling LED companies with a practical, actionable strategic guide for navigating their challenges.

2.1 Strategic Shift: Samsung's Art of Resource Reconfiguration

Strategy prototype: For large, diversified enterprises, the most rational choice is to decisively withdraw resources from low-return, highly competitive "red ocean" markets and reallocate them to emerging or adjacent sectors with superior industry structures and higher growth potential. This approach reflects a capital-allocation mindset rooted in opportunity costs.

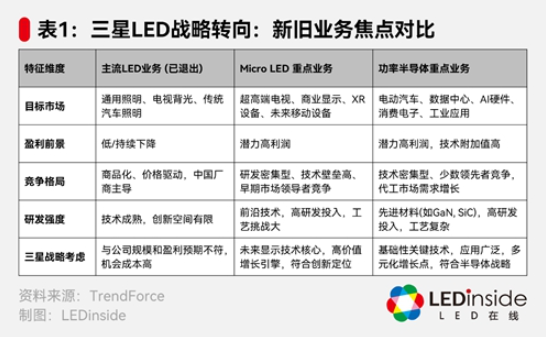

Samsung Case Study: Samsung Electronics serves as a textbook example of this strategic approach. Faced with commoditization and eroding profit margins in the global LED market, Samsung made the tough but wise decision to gradually phase out its mainstream LED business. The company’s exit timeline is clear and unwavering: it will halt production of LED chips for lighting applications in the first half of 2026, withdraw from the TV LED backlight business in the second half of the same year, and is widely expected to completely exit other commodity-based LED markets by the end of 2030.

This retreat is not a rout—it’s a carefully planned strategic pivot. Samsung is leveraging its robust financial strength and cutting-edge R&D resources to focus on two new battlegrounds with high barriers to entry and significant growth potential: Micro LED and power semiconductors.

The following table outlines the strategic considerations behind Samsung's shift in its LED business.

Samsung’s decision-making logic is this: rather than squandering valuable resources in a fiercely competitive market with razor-thin margins, it’s better to channel those resources into emerging fields that can build technological moats and deliver sustained, high returns over the long term. This isn’t just about chasing higher profits—it’s also about securing the company’s leadership position in the next-generation technology revolution.

Samsung is itself a key player in the LED industry, and its case serves as a readily available reference model for LED companies right at their doorstep.

2.2 Cycle of Endurance: Micron's Survival Strategy in the DRAM War

Strategy prototype: In brutally cyclical or commoditized industries, survive the industry reshuffling by achieving extreme internal cost control and proactively reshaping external market rules—ultimately emerging as the "last survivor." Once competitors have been eliminated, you’ll reap the rewards of increased market concentration. This is a long-term battle that demands endurance, capital, and unwavering strategic resolve.

Micron Case Study: The DRAM war of the 1980s was one of the most brutal business battles in semiconductor history. At the time, Japanese companies leveraged their formidable manufacturing capabilities and a controversial "dumping" strategy—selling DRAM chips at rock-bottom prices—to dominate global markets, ultimately forcing U.S. giants like Intel to exit the DRAM business altogether. Amidst the collapse of many American competitors, Micron Technologies miraculously managed to survive—and eventually emerged as the sole survivor of the once-thriving U.S. DRAM industry.

Micron's survival strategy is primarily built on three key pillars:

Ultimate cost control: Micron has positioned itself as one of the industry’s lowest-cost producers through lean manufacturing and continuous process optimization. Even its headquarters is located in Idaho, where costs are lower than in Silicon Valley—the traditional hub of the semiconductor industry. In a price war, cost leadership translates into survival—and it’s this advantage that enables Micron to stay operational even when market prices fall below the cost lines of many of its competitors.

Reshaping the rules of competition: Micron didn’t sit back and take the hit—it took proactive action. By teaming up with other U.S. companies, Micron filed an anti-dumping lawsuit against Japanese DRAM products, ultimately helping to secure the signing of the U.S.-Japan Semiconductor Agreement. This agreement fundamentally altered market dynamics by establishing price floors and specific market-share targets, giving U.S. DRAM firms a much-needed breathing room—and the opportunity to strike back effectively.

Extraordinary strategic patience: Staying steadfast amid prolonged losses and high risks demands immense mental fortitude. Micron weathered the industry’s downturn, patiently waiting for its Japanese and European rivals to be forced out of the market due to their inability to withstand the financial strain. As the balance between supply and demand eventually improves—and the cycle reverses—Micron, one of the three surviving giants, will be poised to reap the bountiful rewards of the industry’s recovery.

Micron's case demonstrates that for companies deeply mired in the quagmire of commoditization, adopting a "stay-the-course" strategy requires two core capabilities: first, internal precision management to achieve unparalleled operational efficiency and cost control; and second, external strength—possessing both the resources and influence needed to shape, or even reshape, the very rules of the game.

While it’s admittedly challenging for LED companies to shape the industry rules, there remains an opportunity to advocate or guide change—perhaps through industry associations—to curb the expansion of homogeneous production capacity and lower barriers for LED firms looking to exit the market.

2.3 Integrated Endgame: BOE-Led Industrial Structure Restoration

Strategy prototype: Initiated by industry-leading enterprises, this approach involves a series of mergers and acquisitions (M&A) to proactively increase industry concentration, eliminate outdated production capacity, and ultimately restore a fragmented industrial structure. By doing so, it strengthens the industry's overall pricing power and profitability—making it a "kingmaker" strategy designed to fundamentally reshape the competitive landscape.

Case Study Analysis of JD.com: The development trajectory of the LCD panel industry shares many similarities with that of LED, as both have experienced periods of oversupply and brutal price wars. As an industry leader, BOE hasn’t stood by while profits were relentlessly eroded—instead, it has adopted a proactive industrial integration strategy, actively stepping into the role of "industry consolidator."

Although the new energy sector also experienced a downturn by the end of 2023, Baoming Technology's transformation efforts themselves are highly inspiring. They showcase a breakthrough strategy that isn’t driven by sheer scale—instead of clinging to its traditional markets, the company can capitalize on its unique strengths to pivot into emerging, high-value areas through a "technology-driven track-switching" approach, ultimately securing a fresh foothold in these promising new fields.

A direct consequence of the merger and acquisition was a significant improvement in market structure. According to data from TrendForce, a series of integrations led to a substantial increase in the market share of BOE and its allies, driving the LCD panel industry’s HHI index from approximately 1,660 (moderately concentrated) prior to the consolidation to around 1,973 afterward—approaching a highly concentrated market scenario. (Refer to "The Final Battle for Panels.")

The increase in HHI signifies a concentration of market power among leading companies, effectively curbing irrational price wars and boosting overall industry profitability expectations. BOE's strategy demonstrates that, for leaders in fragmented markets, the most effective long-term approach may not be to outcompete every rival internally—but rather to leverage capital tactics to integrate competitors into their own operations, thereby ending the prolonged panel wars that have historically stifled profitability in the LCD industry.

In the LED industry, leading companies like Sanan are also taking similar steps. While Sanan’s acquisition of Lumileds was primarily aimed at gaining overseas market access and securing a robust patent portfolio, it has objectively helped accelerate industry consolidation and reduce overall competition within the LED sector.

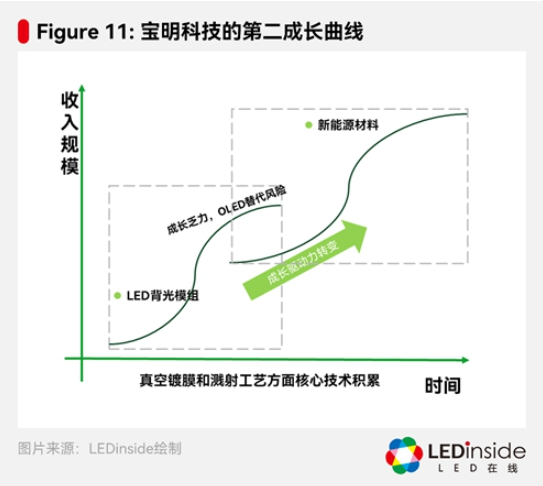

2.4 Value Innovation: Baoming Technology’s Second Growth Curve

Strategy prototype: For small and medium-sized enterprises that lack scale advantages in their existing markets but possess unique core technologies, the optimal path is to pursue value innovation. This involves identifying and refining their most critical, transferable technological capabilities, then applying them to a completely new, high-demand value chain—thereby unlocking a "second growth curve" and escaping the fiercely competitive "red ocean" of their original market.

Baoming Technology Case Study: Baoming Optoelectronics’ original core business was LED backlight modules—a mature market characterized by sluggish growth and the looming threat of OLED technology as a potential replacement. Faced with these challenges, Baoming chose not to engage in cutthroat competition within the LED sector but instead turned its attention to its own established core technologies: vacuum coating and sputtering processes.

Through its interactions with suppliers, Baoming keenly realized that the technology originally developed for display applications could also be applied to critical materials in the new energy sector. As a result, Baoming Optoelectronics initiated its transformation into the lithium battery composite copper foil industry:

Technology Transfer: Baoming has successfully applied its advanced precision coating technology—developed through years of expertise in optical film manufacturing—to deposit copper layers onto base films like PET, creating a composite copper foil product designed as a cost-effective alternative to traditional electrolytic copper foil.

Rapid Execution: R&D was launched in early 2021, and by February 2022, a qualified sample had already been produced. The team then swiftly began sending samples to customers for validation, demonstrating exceptional execution efficiency.

Although the new energy sector also experienced a downturn by the end of 2023, Baoming Technology's transformation efforts themselves are highly inspiring. They demonstrate a突围 path that isn’t driven by sheer scale—instead of clinging to its traditional battlegrounds, the company can leverage its unique capabilities to shift into emerging, high-value areas through a strategy of "technology-driven track switching," ultimately securing a fresh foothold in these promising new fields.

In the small-size backlight module industry, where Baoming Technology operates, the company is facing the challenge of OLED technology gradually replacing traditional solutions—making it, ironically, one of the LED sector's most vulnerable segments to disruption. However, by strategically pivoting its business model, the company has not only transformed itself but also witnessed its market value soar from a billion-yuan level to over ten billion yuan, marking a remarkable shift in quality and performance.

Comprehensive insights:

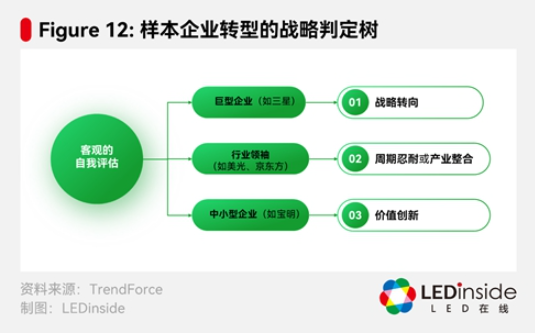

These four strategies are not mutually exclusive—they instead form a "strategic decision tree" rooted in the company’s own resource endowments.

Large corporations with strong capital and diversified R&D capabilities—such as Samsung—have the option to strategically pivot.

Industry leaders with scale and cost advantages in specific sectors—such as Micron and BOE—can choose between enduring market cycles or pursuing industry consolidation.

Small and medium-sized enterprises like Baoming, which may lack scale advantages but possess deep technological expertise, should focus on value innovation.

When formulating their future strategies, LED companies’ top priority should be a clear self-assessment: Are we Samsung, Micron, BOE, or perhaps BOM?

Only by clearly defining your own position can you choose the most suitable path for survival and revival. In the next chapter, let’s explore how leading companies in the LED industry have been attempting strategic transformations and upgrades in response to this competitive landscape.

Chapter 3:

Comparison of Strategies Among Leading LED Companies

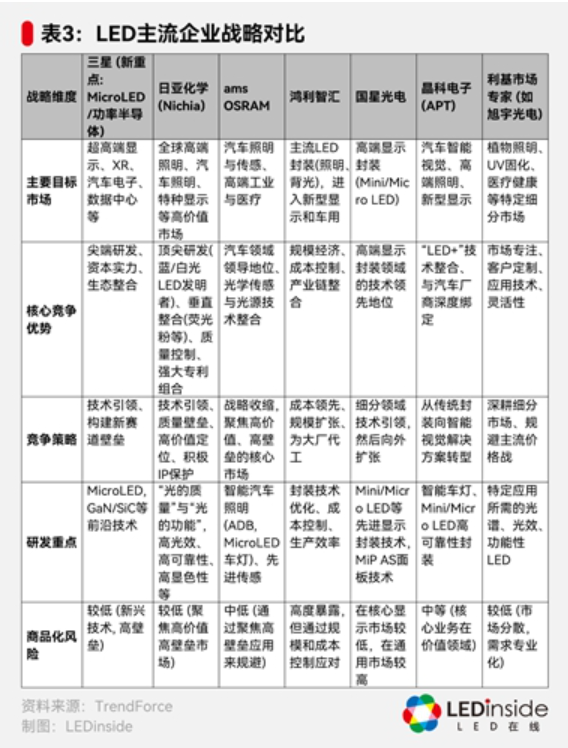

From the case analyses presented earlier, we observe that companies of different types have adopted remarkably diverse strategies to tackle industry challenges. This chapter aims to distill these insights into a more universally applicable comparative strategic framework. By systematically examining the strategic positioning of leading global LED companies and developing a decision matrix, this chapter provides LED firms with a practical tool for self-assessment, benchmarking, and ultimately selecting the most suitable strategic path tailored to their unique circumstances.

3.1 The Strategic Spectrum and Competitive Landscape of Mainstream Enterprises

The global LED market is far from uniform—it’s a complex ecosystem made up of companies pursuing diverse competitive strategies. By analyzing the strategic dimensions of each major player listed in the table below, we can categorize them into distinct strategic clusters, ultimately creating a clear and insightful competitive map.

Based on the table above, we can identify the following typical strategic clusters:

Quality and technology leaders—such as Nichia Chemical—are companies whose competitive moats are built on cutting-edge R&D capabilities, vertical integration of core materials, and a robust patent portfolio. They proactively steer clear of commoditized mass markets, instead focusing on high-value sectors like automotive and premium lighting, where demands for quality, reliability, and "light quality" are exceptionally stringent. As a result, these companies enjoy high gross margins and consistently strong customer relationships. At the heart of their strategy lies "value creation," not "cost reduction."

Focus-oriented, high-value players (such as ams OSRAM): These companies follow a strategy of "strategic contraction and core focus." Once active in multiple sectors, they decisively exited non-core businesses after recognizing the profitability challenges in the broader market. Now, they’re channeling all their resources into markets where they already hold an undisputed leadership position and benefit from significant technological barriers—like automotive lighting and sensing solutions. This approach is a smart move to mitigate commoditization risks by honing in on their strongest competitive advantages.

Scale and cost leaders (such as Hongli Zhihui and Mulinsen): These companies compete in mainstream markets by leveraging economies of scale, exceptional cost control, and highly efficient supply chain management. Their goal is to become the lowest-cost producers in fiercely competitive "red ocean" markets—capturing modest but substantial profits either by manufacturing for major brands or by capitalizing on price advantages to gain market share. However, this strategy exposes them significantly to commoditization risks, placing stringent demands on operational efficiency and meticulous management practices.

Niche-market隐形 champions (such as Xuyu Optoelectronics): These companies steer clear entirely from the mainstream battleground, instead focusing on specialized, fragmented markets like plant lighting, UV curing, and medical health solutions. Their strength lies not in scale or cutting-edge innovation, but in their deep understanding of specific customer needs, rapid ability to deliver customized solutions, and highly adaptable business models. By "deeply cultivating" these niche segments, they build strong customer loyalty while avoiding the price wars that dominate more competitive, mass-market spaces.

Niche-market隐形 champions (such as Xuyu Optoelectronics): These companies completely steer clear of the mainstream battleground, instead focusing on specialized, fragmented markets like plant lighting, UV curing, and medical health solutions. Their strength lies not in scale or cutting-edge innovation, but in their deep understanding of specific customer needs, rapid ability to deliver customized solutions, and highly adaptable business models. By "deeply cultivating" these niche segments, they build strong customer loyalty while avoiding the price wars that dominate more competitive, mass-market spaces.

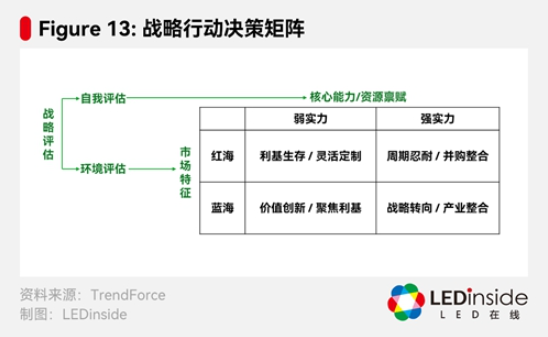

3.2 Action Decision Matrix for Selecting Strategic Pathways:

Based on the competitive map and the strategic prototypes outlined in Chapter 2, LED industry leaders can use a decision matrix to guide their strategic planning. This process requires honestly answering the following key questions:

Step 1: Self-assessment (Who are we?)

Core Competency: What truly makes our company irreplaceable? Is it our deep expertise in MOCVD epitaxial growth, our precision sealing technology, our scalable production management capabilities, or perhaps our profound understanding of a specific application domain?

Resource Endowment: How do our capital strength, R&D investment scale, and talent pool stack up against the industry? Do we have sufficient resources to launch an acquisition or support the development of a new technology that could span several years?

Step 2: Market Assessment (Where are we?)

Battlefield attributes: Is the primary market we’re currently in a highly competitive red ocean (such as general lighting), or an emerging blue ocean with immense potential and high barriers to entry (like premium automotive lighting or Micro LED)?

Competitive Position: In the marketplace we operate in, are we leaders, challengers, or followers? How do our market share and brand influence stand compared to others?

Step 3: Strategic Alignment (Where Should We Go Next?)

If we were a capital-strong, technologically diversified giant (like Samsung): Should we consider a strategic shift, reallocating resources from the low-margin LED business to higher-value areas such as AI semiconductors and power devices?

If we were a market-leading industry giant (like BOE), would we have the capability and willingness to drive industry consolidation—perhaps through mergers and acquisitions—to reshape the sector’s structure and ultimately become the rule-setter?

If we have exceptional advantages in cost control and scalable production (similar to Micron/Huari): Do we possess enough resilience and capital to wage a protracted battle, outlasting our competitors while patiently waiting for the market cycle to deliver returns?

If we’re experts with unique technology but limited scale (like Bomay/Unis), should we pursue a value innovation strategy, focus on applying our core technology to new areas, or aim for excellence in a high-value niche market?

If we’re small and not particularly tech-driven: Should we look for a niche market overlooked by the giants, leveraging our flexibility and ability to offer customer customization to thrive?

The core idea of this decision matrix is that there’s no absolute right or wrong in strategic choices—only whether they align with a company’s inherent strengths and the environment it operates in. Blindly copying Samsung’s pivot without its unique resources, or attempting to drive integration without BOE’s strong market position, would inevitably lead to disaster. Conducting an honest self-assessment through this framework is the first—and most critical—step for LED companies to break free from their current challenges and develop effective strategies.

Chapter 4:

Finding a high-growth haven in the AI-driven semiconductor ecosystem

Although LED companies operate in a highly competitive "red ocean," the III-V semiconductor process expertise they’ve accumulated gives them a natural advantage when entering AI-related markets. For LED firms that still possess the ability to innovate or pivot, the next wave of growth opportunities lies far beyond traditional lighting—instead, it’s in the broader semiconductor industry, driven by the transformative power of artificial intelligence (AI).

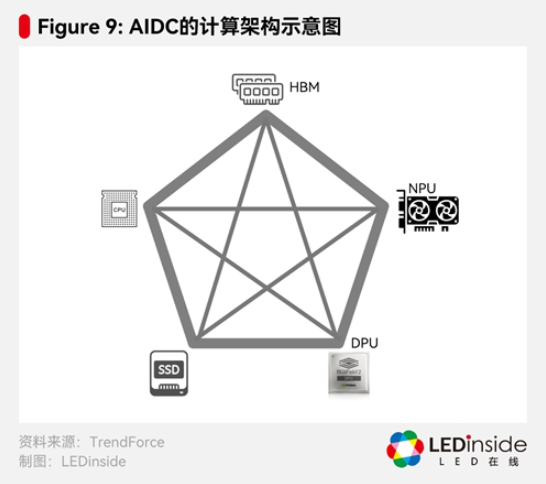

According to TrendForce's systematic research, AI is the most critical and certain demand driver for the entire technology industry over the next decade. As previously mentioned, AI’s demand for computing power exhibits the economically significant characteristic of "increasing returns to scale." Based on this insight, this article identifies several specific emerging market opportunities—characterized by LED companies—that not only hold high growth potential but also demonstrate strong technological synergy with LEDs.

4.1 The "AI Gold Rush": "Selling Shovels" in a Bottleneck Economy

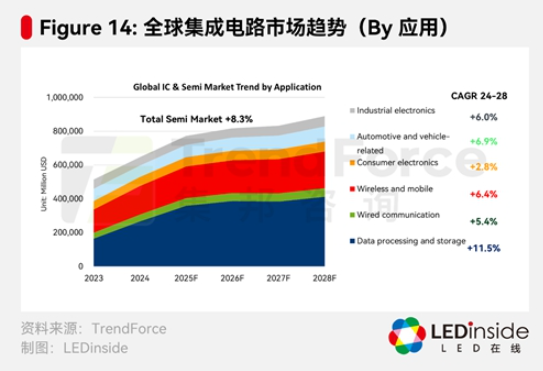

The growth engine of the global semiconductor market is undergoing a fundamental shift.

TrendForce forecasts that data processing and storage (CAGR +11.5%) and automotive electronics (CAGR +6.9%) will be the two fastest-growing sectors between 2024 and 2028, with AI serving as the key driver behind both. The advancement of AI, particularly the explosive growth of generative AI, is reshaping infrastructure demands at an unprecedented scale and pace.

The core investment logic in this field can be succinctly summarized as the "bottleneck economy." The insatiable demand for computing power—led by GPUs—driven by AI large models has given rise to three new, critical infrastructure bottlenecks:

Power bottlenecks: The power density of AI servers is soaring rapidly, posing unprecedented challenges to data center power supply and energy efficiency.

Cooling bottleneck: Chip power consumption—reaching hundreds or even thousands of watts—generates immense heat. Traditional air-cooling technologies are already approaching their physical limits, effectively creating a "thermal wall."

Transmission bottlenecks: Within servers (between chips) and across server clusters, the high-speed exchange of massive data has become a critical bottleneck limiting overall performance.

For companies seeking to transform, rather than directly challenging industry giants like Nvidia—companies that have already established an ironclad monopoly in the core computing chip space—a smarter strategy would be to position themselves as the "shovel sellers" in the AI gold rush: offering the critical technologies and products that address the three major bottlenecks mentioned earlier. While these "shovels" may not shine as brightly as the "gold" (GPUs), they are an indispensable part of the entire ecosystem—and come with immense industry appeal and significant profit potential.

4.2 High-Potential Target Markets: Detailed Analysis

Based on the logic of the "bottleneck economy," this paper identifies four target markets that are highly relevant and feasible for LED companies to pursue as part of their transformation strategy.

Market-driven: The electrification,智能化 (smartification), and connectivity trends in the automotive industry are transforming cars into "data centers on wheels," sharply boosting both the demand for and the value of semiconductors. Moreover, the application of AI technology in autonomous driving is further intensifying the need for high-performance sensors, processors, and power devices.

Market Driver: AI servers are pushing the efficiency requirements for power supply units (PSUs) to their limits. Higher power efficiency translates into lower energy consumption and reduced cooling costs—benefits that become especially significant in large-scale data centers, where tens of thousands of servers are often deployed.

Technological Opportunity: The third-generation semiconductor material gallium nitride (GaN) offers a decisive advantage over traditional silicon (Si)-based devices in the field of high-frequency, high-efficiency switching power supplies. Data shows that GaN-based PSUs can achieve efficiencies exceeding 96%, significantly surpassing conventional solutions—and as operating temperatures drop, their performance benefits become even more pronounced.

Market Outlook: Data centers are undergoing a profound transformation in their power infrastructure, as server rack power levels rapidly escalate from kilowatt to megawatt ranges. Consequently, the power delivery model is shifting toward an 800V HVDC (High-Voltage Direct Current) architecture. GaN is set to become the key semiconductor technology driving this transition, with several leading GaN manufacturers—including Innoscience, Navitas Semiconductor, and Infineon—announcing their participation in NVIDIA’s 800V HVDC initiative.

Synergy with LEDs: Extremely high. The core materials of LEDs—such as InGaN—are part of the same nitride (III-V group) semiconductor family as GaN power devices. LED companies have amassed deep expertise in MOCVD epitaxial growth, material property understanding, and chip manufacturing processes, which can be seamlessly transferred to the R&D and production of GaN power devices. This makes it the most direct and critical pathway for technology transfer. Among LED manufacturers, BOE Huacan has leveraged its extensive experience in GaN materials to enter the GaN power device market, while Nationstar Optoelectronics has applied its proven packaging technologies and industry know-how from the LED sector to the assembly and testing of third-generation half-devices.

Next-generation cooling technologies (especially liquid cooling)

Market driver: The high heat flux density of AI servers is pushing traditional air cooling to its limits, making liquid cooling technology shift from a "nice-to-have" to an "essential" solution.

Technological Opportunity: The data center liquid cooling market is projected to grow rapidly at a robust annual compound growth rate exceeding double digits. Mainstream solutions include cold plate liquid cooling and immersion cooling, driving demand for a range of components and solutions such as cooling fluids, pumps, cold plates, quick-connect fittings, and advanced monitoring systems.

Market Outlook: China's liquid-cooled server market in data centers is projected to surge from under $2 billion in 2023 to nearly $12 billion by 2028—showing rapid growth.

Synergy with LEDs: Moderate. While thermal management technology itself primarily involves fluid dynamics and thermal engineering, LED companies—especially those engaged in the high-power LED lighting industry chain—have also accumulated significant expertise in areas such as heat sink substrates, thermal interface materials (TIM), and system-level thermal design. This experience can serve as a solid foundation for entering the market by supplying key components in this space.

High-speed optical transceiver

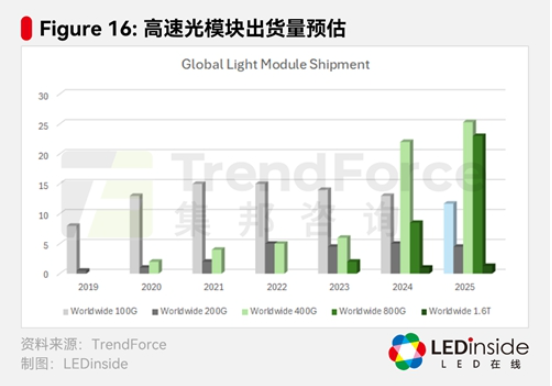

Market Drivers: In AI clusters, massive data communication is required between GPUs (e.g., via NVLink), creating an exponentially growing demand for data transmission bandwidth. This, in turn, is driving rapid advancements in optical communication transceiver technology—from 400G and 800G all the way up to 1.6T and beyond.

Technological Opportunities: The high-speed optical transceiver market is projected to grow rapidly at a robust annual compound growth rate of 17%. Key technology trends include more integrated and cost-effective Silicon Photonics solutions, as well as Co-Packaged Optics (CPO) technology.

Market Outlook: Shipments of 800G and 1.6T optical modules are expected to experience explosive growth in the coming years.

Synergy with LEDs: Extremely high. At the heart of optical communication transceivers lies photoelectric conversion, a fundamental physical principle closely tied to LED technology—both rely on semiconductor optoelectronics. LED companies possess critical expertise in epitaxy, manufacturing, packaging, optical design, and high-frequency signal processing for laser (LD) and detector (PD) chips, making these capabilities invaluable assets as they transition into the optical communications sector. This represents an ideal path for technological convergence and alignment within closely related industry chains, especially now that Micro LEDs can be leveraged as communication light sources. Among LED manufacturers, Zhongchi, Sanan, and Jufei have already embraced this strategic direction.

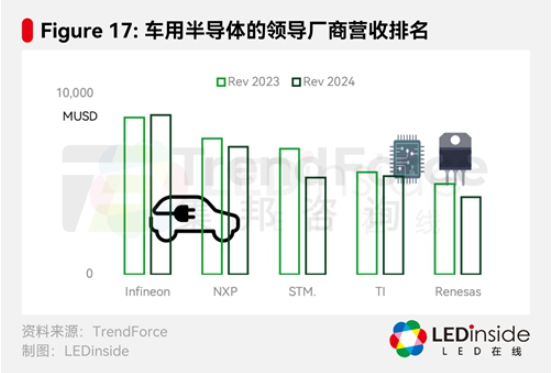

Automotive semiconductors

Market-driven: The electrification,智能化 (smartification), and connectivity trends in the automotive industry are transforming cars into "data centers on wheels," sharply boosting both the demand and value of semiconductors. Moreover, the application of AI technology in autonomous driving is further fueling the need for high-performance sensors, processors, and power devices.

Technological Opportunity: The automotive semiconductor market is projected to grow steadily from $67 billion in 2024 to $88.5 billion by 2028. Among these applications, GaN devices are demonstrating significant potential in areas such as on-board chargers (OBC), DC/DC converters, and LiDAR systems.

Market Outlook: Although the market is dominated by established European, American, and Japanese manufacturers such as Infineon and NXP, and despite the extremely high barriers to automotive-grade certification, the segment’s high value and steady growth continue to make it highly attractive.

Collaboration with LEDs: High. LED companies have long been part of the automotive supply chain—specifically in automotive lighting—and have thus developed a deep understanding of automotive-grade quality management systems (such as IATF 16949), stringent reliability requirements, and established, long-term supplier relationships. Building on this expertise, expanding their product portfolio from automotive LEDs to optoelectronic semiconductors like GaN-based power devices or LiDAR light sources represents a logically seamless path for enhancing value.

In summary, for LED companies seeking transformation, the most strategically valuable path is not to blindly chase after every industry buzzword—but rather to focus on adjacent markets that allow them to fully leverage their existing core competencies. Among these, GaN power semiconductors and high-speed optical communications stand out as the two clearest and most promising strategic directions for transformation. This is because both fields share a strong technical and material foundation with LEDs, making them logical next steps with the highest likelihood of success.

Conclusion:

The Strategic Choice from the Red Sea to the Blue Ocean

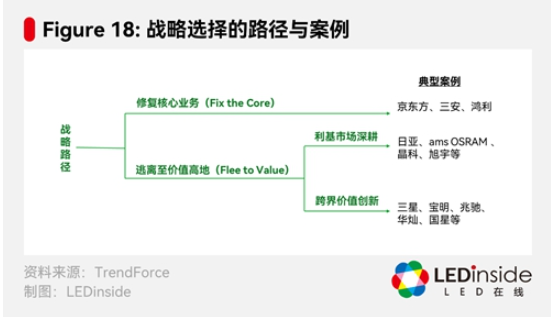

An undeniable reality is that the LED industry—particularly in mainstream markets like general lighting and traditional display backlights—is currently grappling with a major crisis, driven by the fragmentation of market structures, imbalanced policy guidance, and the maturation of technology life cycles.

In this crisis, profit margins have been severely squeezed, rendering traditional strategies of scaling up and competing on cost ineffective. For businesses caught in the middle, passively waiting for market conditions to improve—or simply pinning their hopes on a cyclical recovery—no longer constitutes a viable option.

Faced with a harsh reality, LED companies’ leadership must make a fundamental strategic decision. Everyone is confronted with a difficult yet essential choice: Should they stick to their core and focus on recovery, or pivot and break through to new opportunities?

In fact, there are only two paths ahead:

First is "Fix the Core"—a path that only a handful of industry leaders can afford to take. These companies must step into the role of "industry integrators," following BOE's successful blueprint in the LCD sector: driving consolidation through mergers and acquisitions, boosting market concentration, weeding out outdated production capacity, and ultimately restoring industry order and profitability. It’s a high-investment, high-barrier journey toward becoming the undisputed king of the market—aiming to turn today’s red ocean back into a vibrant blue one.

Second, "Flee to Value"—a more realistic choice for most businesses.

Niche Market Deep-Dive: Drawing inspiration from Nichia Corporation or ams OSRAM, we’re proactively scaling back to steer clear of the crowded, highly competitive "red ocean" markets. Instead, we’re focusing our resources on high-value niche segments such as premium automotive lighting, specialized industrial applications, and Micro LED technologies—areas where we can leverage cutting-edge technology and uncompromising quality to carve out a distinct competitive edge.

Cross-border value innovation: By emulating companies like Samsung or BOM Technology, identify and transfer your core process capabilities—such as III-V epitaxy and optoelectronic packaging—to tap into emerging markets like GaN power semiconductors and high-speed optical communications under the AI infrastructure framework, turning your existing strengths into a brand-new engine for growth.

These cases collectively demonstrate that the future of LED companies doesn’t necessarily lie in clinging tightly to their existing markets—but rather in precisely identifying and strategically shifting their core competencies.

Ultimately, the golden age of the LED industry has already come to an end, but the semiconductor processes, optoelectronic technologies, and industry-chain capabilities it has cultivated remain invaluable. In fact, in the AI-driven new era, these assets have become even more precious than before. The real challenge lies in whether companies can break free from entrenched path dependencies, boldly withdrawing these assets from the fiercely competitive red ocean—and redeploying them instead into promising blue-ocean opportunities.

This isn’t just a matter of survival—it’s also the path to leaping into a new wave of industry transformation. The value of the LED industry hasn’t vanished; instead, it’s waiting to be reactivated and rediscovered in entirely new arenas. Whether or not companies can seize these emerging opportunities will not only shape their own futures but also determine how the entire industry repositions itself in the age of AI.

More news